Business Expenses Domain Name

You may have listed it as an expense for a small business but again that is a poor classification. It could be confusing later on if you have been accruing expenses for the same service in two or more accounts.

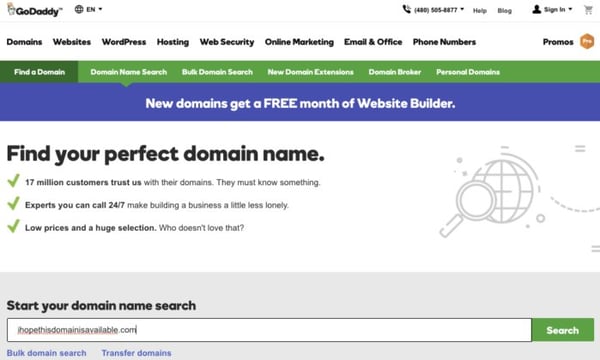

How Much Does A Domain Name Cost Pricing Breakdown 2021

How Much Does A Domain Name Cost Pricing Breakdown 2021

These are deductible from income a business may earn in the same tax year.

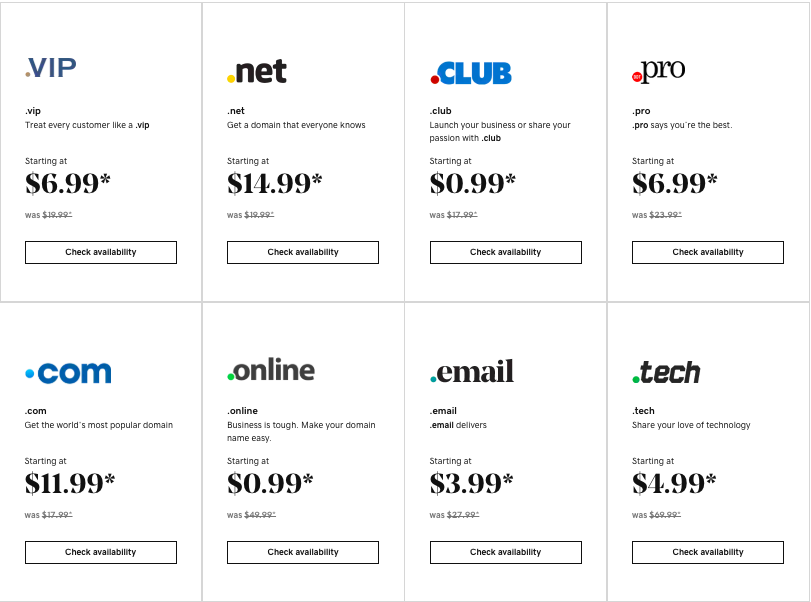

Business expenses domain name. However if the domain name itself is accompanied by the acquisition of other assets tangible or intangible more crafty accounting is needed. Specific accounts may be in place such as Office Supplies Expense Store Supplies Expense and Service Supplies Expense. Domain privacy might be included in registration or as an add-on service starting at about 8 per year.

Keep in mind rent paid on your home should not be deducted as a business expense even if you have a home office. Franchise trademark and trade name. Any payments made on behalf of a prospective employee during the interview process are deductible business expenses.

If you do create a new account and you are a sole proprietorship using QB to help with tax returns just be sure you put the tax-line mapping to Schedule C. Mobile phone and laptop expenses can also be included in the office expenses. The Schedule C isnt really that complicated especially if you use a tax prep program like TurboTax or TaxCut.

Or do I need to have the. Always consult with a CPA to determine the exact requirements for your locale and business functions. Varies greatly depending on registrar domain name and extension and available promotions.

In contrast a premium domain can cost thousands even millions. Decide Whether Its an Asset or an Expense. License Fees and Taxes - business taxes registration and licensing fees paid to the government.

General registration added domain name protection services and recurring maintenance costs for a domain name are all considered regular business expenses. That rent can be deducted as a part of home office expenses. Other business expenses so you get the business deduction come tax time.

If a business purchases a domain name for a nominal amount of money -- 100 or 500 for example -- it can immediately expense the purchase. Tax Treatment of Domain Name Costs. The domain name is treated as an intangible asset because it generates revenue externally through ads or can be sold at a later date.

As the name implies variable expenses vary from month to month and are also commonly your biggest expense. When you purchases a domain name that already exists or invests heavily to develop that domain name as a brand and trademark then the IRS looks at the related expense as a permanent business benefitSuch expenses move toward capital costs that need to be depreciated over time. The IRS looks at domain name costs in two ways.

The Internal Revenue Service treats assets differently from expenses and which category your domain name. Here are the 25 most expensive domain names publicly reported. However a business that buys a domain name that is significant to the business and pays more than 1000 for it may choose to capitalize it as an intangible asset.

I posted tax treatment because as an expense you would be lying about its purpose. Publication 535 Business Expenses on the IRS website offers more in-depth information on non-deductible expenses. Its not unusual to see domain specials starting at 99 cents per year.

How much profit can a domain registration business make. Without having an LLC set up. For most freelance businesses deducting website expenses small business web services or deducting domain name registration fees happens on the Schedule C.

The standard fee is about 10 a year for a domain name but this number can rise and fall depending on demand or company promotion. Keep a Paper Trail. Supplies Expense - cost of supplies ball pens ink paper spare parts etc used by the business.

They are valid business expenses but their cost must be amortized in the US and other countries unlike the cost of domains acquired in order to resell domain. How to Deduct Business Expenses You must complete and file Schedule C with your tax return to itemize your business costs and to calculate how much business income is left over after you deduct them. Subscriptions computer domain name etc.

Capital costs and ongoing recurring business expenses. Fees paid to purchase a franchise trademark or trade name are tax-deductible business expenses. If you rent a business location or equipment for your business you can deduct the rental payments as a business expense.

Payroll expenses may jump around if you use freelancers or offer overtime pay and equipment rental frequently shows up as a variable expense too. Can I deduct small business start up expenses ie. Domain name acquisition costs are expenses made towards intangible objects.

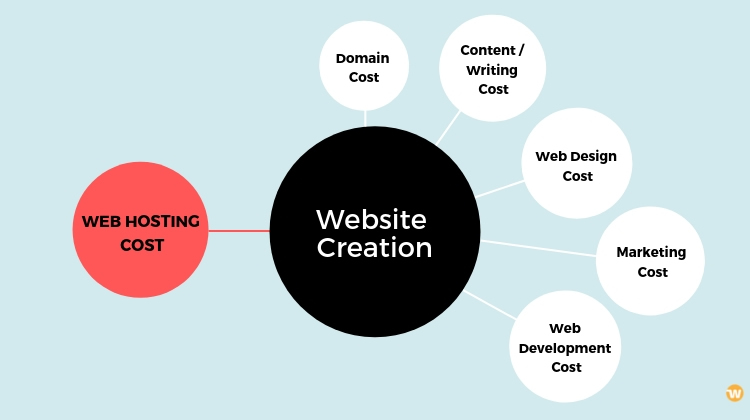

5 Office expenses Offices expenses are the type of expenses which are necessary to run an office such as internet service website domain name charges rented software hardware cost cloud storage services like cloud BOX Onedrive etc.

How Much Is A Website Domain Name Hostgator Blog

Start Your Own Online Business In 4 Simple Steps Web Business Online Business Business Infographic

Start Your Own Online Business In 4 Simple Steps Web Business Online Business Business Infographic

Bluehost Pricing What To Expect From Their Plans Prices

Bluehost Pricing What To Expect From Their Plans Prices

How To Register Your Website S Domain Name For Free

How To Register Your Website S Domain Name For Free

How Much Does It Cost To Build A Website

How Much Does It Cost To Build A Website

How Much Does A Domain Name Cost Namecheap Blog

How Much Does A Domain Name Cost Namecheap Blog

We Break Down The Costs Of Building Managing A Website

We Break Down The Costs Of Building Managing A Website

How Much Does It Cost To Host A Website 2021 Data

How Much Does It Cost To Host A Website 2021 Data

How Much Does A Domain Name Cost Domain Com Blog

How Much Does A Domain Name Cost Domain Com Blog

How Much Does A Domain Cost Dreamhost

How Much Does A Domain Cost Dreamhost

Weebly Pricing Review Which Plan Should You Choose

Weebly Pricing Review Which Plan Should You Choose

10 Best Domain Name Brokers Auction Markets Compared

10 Best Domain Name Brokers Auction Markets Compared

Do You Need A Business Name To Create A Website

Do You Need A Business Name To Create A Website

How Much Does A Domain Name Cost A Beginners Guide

How Much Does A Domain Name Cost A Beginners Guide

Domain Name Registration Domain Registration Domain Name Checker Domain Registration Domain Registration

Domain Name Registration Domain Registration Domain Name Checker Domain Registration Domain Registration

Average Cost Of Website Design For A Small Business Broadly Com

Average Cost Of Website Design For A Small Business Broadly Com

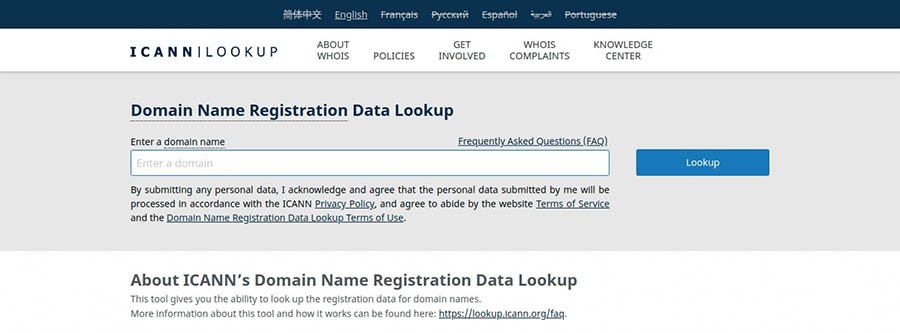

Do You Have A Domain Name Here S What You Need To Know Part 1 Icann

Do You Have A Domain Name Here S What You Need To Know Part 1 Icann

Ow Cost Domain Names Offer An Easy Way To Get Online We Offer All Tld At Low Price Remember Choosing Domain Name Is Im Hosting Company Best Web Web Hosting

Ow Cost Domain Names Offer An Easy Way To Get Online We Offer All Tld At Low Price Remember Choosing Domain Name Is Im Hosting Company Best Web Web Hosting

Where Do I Deduct Website Expenses On Schedule C Taxes Arcticllama Com

Where Do I Deduct Website Expenses On Schedule C Taxes Arcticllama Com

Post a Comment for "Business Expenses Domain Name"